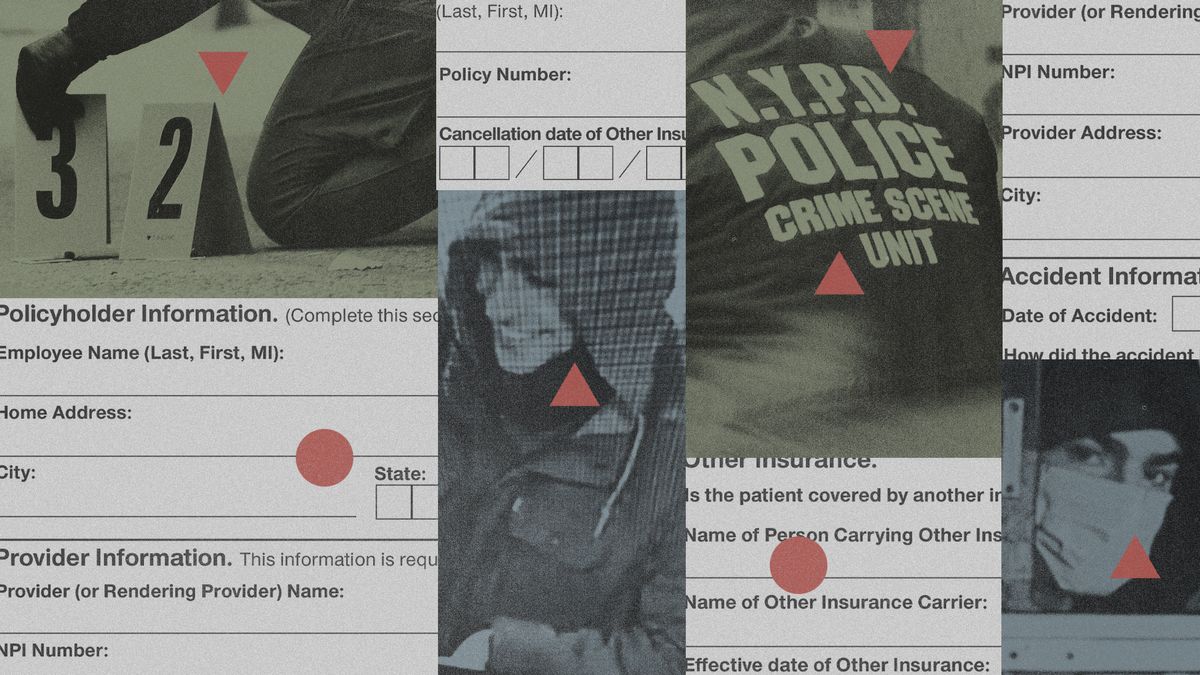

Introduction: A Shocking Tragedy with Far-Reaching Implications

The recent murder of a prominent CEO in the health insurance sector has sent shockwaves through the industry, raising questions about its stability, ethics, and the potential for a transformative reckoning. While the incident itself is tragic, the ripple effects are already being felt across the broader healthcare and financial sectors. In the wake of the CEO’s untimely death, both stakeholders and analysts are grappling with the implications for the future of health insurance, corporate leadership, and even regulatory oversight.

This article explores the various dimensions of this tragic event, examining its potential impact on the health insurance industry, the broader economy, and the ethical questions surrounding corporate governance and leadership. As the dust begins to settle, the sector faces a critical moment that could shape its trajectory for years to come.

The Health Insurance Sector: An Overview of its Current Landscape

The health insurance sector is one of the most complex and influential industries globally, playing a central role in how healthcare services are delivered and financed. In the United States alone, the sector generates hundreds of billions in revenue, providing insurance coverage to millions of Americans. The CEOs at the helm of these massive corporations hold considerable power, shaping not only the financial fortunes of their companies but also influencing public health policy, government regulations, and the overall healthcare landscape.

- Major Players: Key players in the industry include insurance giants like UnitedHealth Group, Anthem, and Cigna, which collectively hold a significant portion of the market share.

- Market Size: The U.S. health insurance market was valued at over $1 trillion in 2023 and is expected to grow steadily due to increasing demand for healthcare services and aging populations.

- Regulatory Oversight: The sector is heavily regulated, with state and federal agencies monitoring pricing, claims processing, and healthcare standards. The Affordable Care Act (ACA) has also introduced reforms designed to make healthcare more accessible to Americans.

Given the vital role health insurers play, the loss of a key CEO, especially under such violent and tragic circumstances, can trigger both immediate concerns and long-term effects on the industry’s functioning and reputation.

The Murder: Impact on the Company and the Industry

The murder of a health insurance CEO is a rare and unsettling event that raises several critical questions. At the individual company level, there is the immediate concern over leadership succession, governance stability, and investor confidence. At the industry level, however, the tragedy could bring about more profound shifts, potentially leading to a reevaluation of practices, policies, and even the ethical standards of corporate leadership.

Leadership Crisis and Succession Challenges

In any corporation, the sudden death of a CEO often results in a period of uncertainty. The health insurance sector is no different. With the CEO’s leadership at the helm, decision-making processes, strategic direction, and company culture are often deeply influenced by their vision and personal style. In cases where leadership succession plans are not robust, the loss of a CEO can lead to a leadership vacuum, which in turn affects day-to-day operations.

The immediate priority for the company will be to appoint an interim or permanent successor who can restore stability. However, selecting a new leader in the wake of such a shocking event is not without its challenges. The new CEO will need to balance the company’s short-term operational needs with the long-term goals of navigating a transformed industry landscape.

Investor Confidence and Market Reactions

Stock prices are often directly influenced by news of leadership changes, particularly when a CEO’s actions are integral to the company’s success. In the case of a murder, investors may react with caution, unsure of what the company’s future holds without its previous leader at the helm. Financial analysts often examine the background of the company’s leadership team and their ability to adapt to unforeseen challenges. A sudden loss could cause volatility in stock prices and potentially prompt a reassessment of the company’s valuation.

Broader Industry and Public Repercussions

Beyond the affected company, the health insurance sector as a whole could feel the impact of such a high-profile event. In the public eye, the murder of a prominent CEO can cast a shadow over the entire industry. Stakeholders, including regulators, healthcare providers, and policymakers, may view the event as a sign that the sector is facing deeper ethical and governance-related issues.

For example, if the murder is linked to corporate or personal rivalries, it could open up questions about the culture of competition within the industry. While this would be an extreme scenario, the very possibility could create a public relations nightmare for the entire sector, especially if systemic issues regarding corporate responsibility and transparency are uncovered.

Ethical and Governance Issues in the Health Insurance Industry

The tragic event of a CEO’s murder also opens up broader conversations about ethics in corporate governance. While the incident may not directly reflect the ethical standards of the broader industry, it brings to the surface issues related to corporate culture, executive compensation, and transparency in decision-making.

Executive Compensation and Public Perception

One of the most contentious issues in the corporate world is executive compensation. In the health insurance industry, where profit margins can be substantial, CEOs often receive significant salaries, bonuses, and stock options. While these compensation packages are legally structured and often tied to performance metrics, there is a growing public debate about the fairness and morality of such pay packages—especially in industries that are vital to public well-being, like healthcare.

The murder of a CEO can reframe the conversation about executive compensation. If it is revealed that the individual’s personal wealth was tied to controversial decisions—such as reducing benefits or increasing premiums—it could create a backlash against the entire sector. It may prompt policymakers to reconsider the ethics of high executive pay in an industry that often faces criticism for its role in rising healthcare costs.

Corporate Governance and Leadership Ethics

Leadership in the health insurance sector has historically been scrutinized for its focus on profitability at the potential expense of patient care. A CEO’s murder—if connected to unethical practices or conflicts within the company—could catalyze a broader call for reform. This could involve greater transparency in corporate governance, stronger accountability measures, and more effective checks on power within health insurance companies.

Regulatory Implications and Potential Reforms

In light of this tragedy, there is a real opportunity for regulators to take a more active role in shaping the future of the health insurance industry. The sector is already one of the most highly regulated industries in the world, but ongoing scrutiny of business practices, particularly in the wake of leadership crises, may prompt even tighter controls.

There may be calls for:

- Stronger ethical guidelines for health insurance executives and boards of directors.

- Enhanced whistleblower protections for employees who wish to report unethical conduct.

- Increased oversight of mergers and acquisitions within the sector to prevent anti-competitive behavior.

- Improved transparency in how insurance premiums are set and how claims are handled.

While the murder itself is a rare and tragic event, the subsequent fallout has the potential to trigger meaningful reforms that could reshape how health insurers operate and interact with the public and government. Given the public concern surrounding healthcare access and costs, regulators may take this opportunity to push for more patient-centered policies and greater corporate responsibility.

Conclusion: The Path Forward for the Health Insurance Sector

The murder of a high-profile CEO in the health insurance sector is a tragedy with far-reaching implications. It raises important questions about the industry’s ethics, governance, and future stability. While the immediate impact will be felt by the affected company and its stakeholders, the broader industry must also take this moment to reflect on its practices and consider whether reforms are necessary to restore public trust and ensure long-term stability.

As the sector moves forward, it will likely face increased scrutiny from regulators, investors, and the public. The real challenge for health insurers will be to embrace the opportunity for change, ensuring that leadership and business practices align with the broader public interest. Only time will tell whether this tragic event will catalyze meaningful reform, but it has certainly sparked an important conversation about the future of health insurance.

For more insights on corporate governance and industry ethics, visit this resource.

See more WebMD Network