Trump Proposes US Drug Pricing Reform: A Challenge to Global Norms

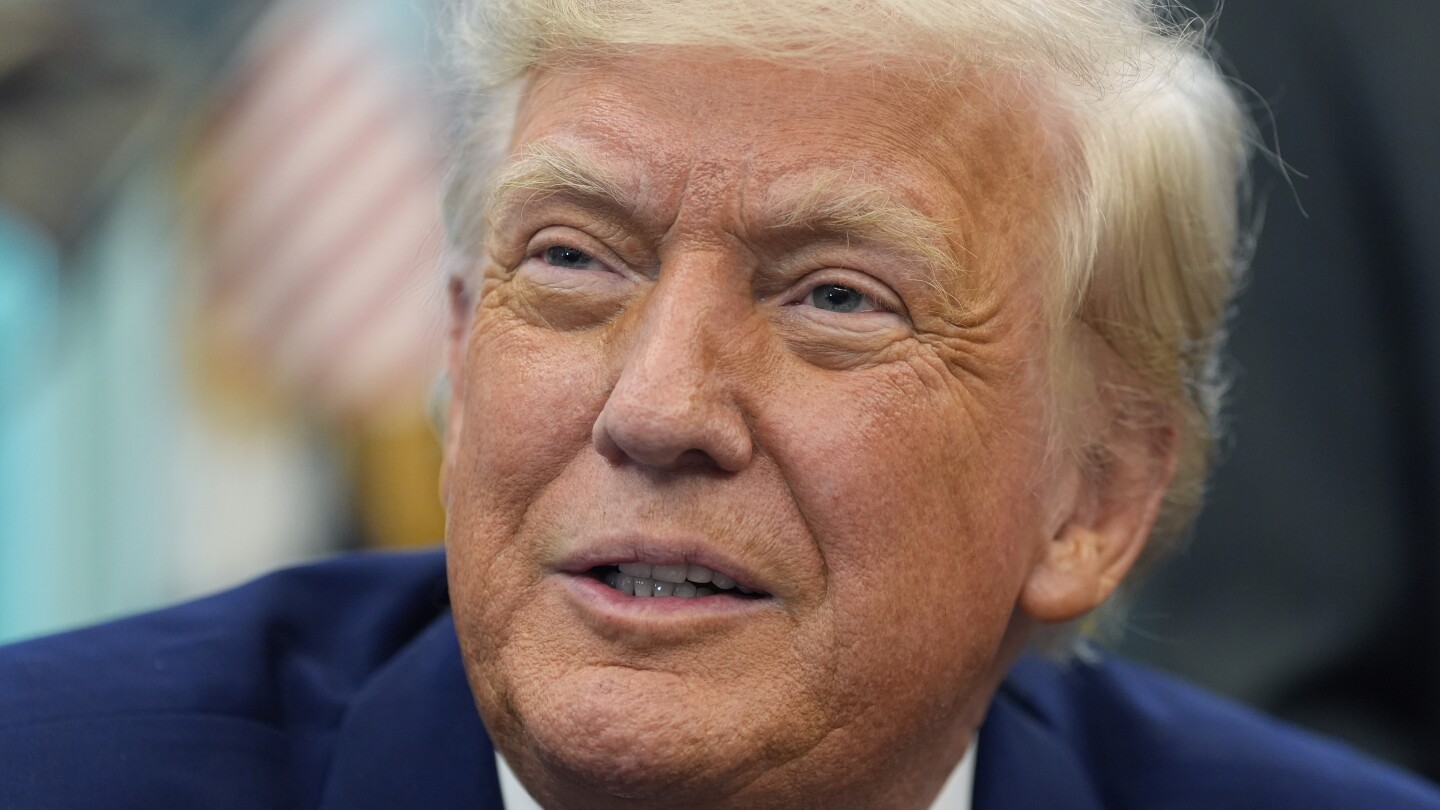

Former President Donald Trump has announced a sweeping proposal to align U.S. prescription drug prices with those of other developed nations, vowing Americans will “no longer pay more than any other country” for medications. The plan, unveiled during a campaign rally in Philadelphia, could dramatically alter pharmaceutical pricing structures, potentially sparking conflicts with global manufacturers and foreign governments. Trump aims to implement the policy if re-elected in 2024, using international reference pricing—a system that ties domestic costs to median prices abroad.

The Mechanics of Trump’s Drug Pricing Overhaul

The proposed reform would establish a “Most Favored Nation” pricing model requiring drugmakers to charge the U.S. no more than the lowest price offered to comparable nations. Currently, Americans pay 2.5 times more for prescription drugs than peer countries according to a 2021 RAND Corporation study, with some specialty medications costing 4-6 times international prices.

“We’re being played for fools by global pharmaceutical companies,” Trump stated during his address. “The same pill that costs $6 in France costs $600 here. That ends on Day One of my administration.”

The plan builds on a 2020 executive order that was never fully implemented, proposing to:

- Create an international pricing index for 250 high-cost medications

- Allow Medicare to negotiate directly with manufacturers

- Impose tariffs on companies refusing compliance

- Fast-track approval of cheaper foreign-made alternatives

Potential Impacts on Pharmaceutical Markets

Industry analysts warn the policy could trigger a seismic shift in global drug economics. “This isn’t just about U.S. prices—it would upend the entire pharmaceutical ecosystem,” explains Dr. Miriam Klein, healthcare economist at the Brookings Institution. “Many countries rely on U.S. profits to subsidize their own low prices. Remove that profit center, and global R&D funding could drop by 30-40% within a decade.”

Recent data from the Congressional Budget Office suggests the proposal might save Medicare $450 billion over 10 years. However, a 2023 IQVIA Institute report projects such savings could come at the cost of 15-20 fewer new drug approvals annually as companies reduce research investments.

International Reactions and Trade Implications

European health ministers have cautiously monitored the proposal, with Germany’s Karl Lauterbach noting, “Reference pricing works when one country does it. If the world’s largest healthcare market adopts this strategy, we’ll need entirely new models for drug development.” Meanwhile, pharmaceutical stocks dipped 3-5% following Trump’s announcement.

The plan faces significant implementation challenges:

- Potential WTO violations under trade agreements

- Legal battles over intellectual property rights

- Need for congressional approval on key provisions

- Risk of drug shortages if manufacturers limit U.S. supplies

Patient Advocacy Groups Divided on Proposal

While AARP has praised the initiative as “long overdue relief for seniors,” rare disease organizations express concern. “Many breakthrough therapies for conditions like cystic fibrosis or ALS originate from U.S. research,” notes Patients for Orphan Drugs director Ryan Colburn. “This could dry up the pipeline for treatments affecting millions.”

Conversely, grassroots groups like Lower Drug Prices Now highlight that 1 in 4 Americans currently skips doses due to costs. “When insulin costs $98 in Canada versus $340 here, that’s not innovation—that’s price gouging,” argues spokesperson Lila Montoya.

The Road Ahead for Drug Pricing Reform

As the 2024 election cycle intensifies, Trump’s proposal sets up a stark contrast with Biden administration efforts like the Inflation Reduction Act’s limited Medicare negotiation provisions. Pharmaceutical companies are preparing aggressive counterarguments, including a projected loss of 500,000 industry jobs in a recent Pharmaceutical Research and Manufacturers of America (PhRMA) impact study.

Key developments to watch include:

- Potential legal challenges to executive authority on pricing

- State-level pilot programs testing reference pricing models

- Emerging bipartisan alternatives in Congress

- November election results determining policy viability

With U.S. drug expenditures exceeding $600 billion annually—representing 40% of global pharmaceutical revenue—the outcome of this proposal could reshape healthcare economics worldwide. As stakeholders prepare for battle, patients await solutions to a crisis where 28% of adults report difficulty affording prescriptions according to Kaiser Family Foundation polling.

For continuing coverage on healthcare policy reforms, subscribe to our policy briefing newsletter for weekly expert analysis.

See more WebMD Network